Do Wall Street Analysts Like Digital Realty Trust Stock?

Valued at a market cap of $56.1 billion, Digital Realty Trust, Inc. (DLR) operates as a real estate investment trust (REIT) that owns, acquires, develops, and operates data centers. Headquartered in Austin, Texas, the company delivers the full spectrum of data center, colocation, and interconnection solutions across over 25 countries on six continents.

Shares of the REIT have notably outperformed the broader market over the past 52 weeks. DLR has risen 16% over this time frame, while the broader S&P 500 Index ($SPX) has gained 8.6%. However, shares of DLR are down 6.1% on a YTD basis, compared to SPX’s 3.8% dip.

Looking closer, Digital Realty has also outpaced the Real Estate Select Sector SPDR Fund’s (XLRE) 9.6% surge over the past 52 weeks and 2.3% return on a YTD basis.

Digital Realty stock rose nearly 4% following its Q1 2025 results on Apr. 24. The company reported revenue of $1.4 billion, marking a 5.7% increase from the prior-year quarter. Adjusted EBITDA grew 11.3% year-over-year to $791.2 million, while AFFO per share rose 6% from the year-ago quarter to $1.78. Its core FFO stood at $1.77 per share.

Additionally, DLR raised its full-year 2025 guidance. The company now expects total revenue to range between $5.8 billion and $5.9 billion, and Core FFO to be between $7.05 per share and $7.15 per share.

For the current fiscal year, ending in December 2025, analysts expect DLR’s core FFO to increase 5.7% year-over-year to $7.09 per share. The company's earnings surprise history is strong. It beat or met the consensus estimates in the last four quarters.

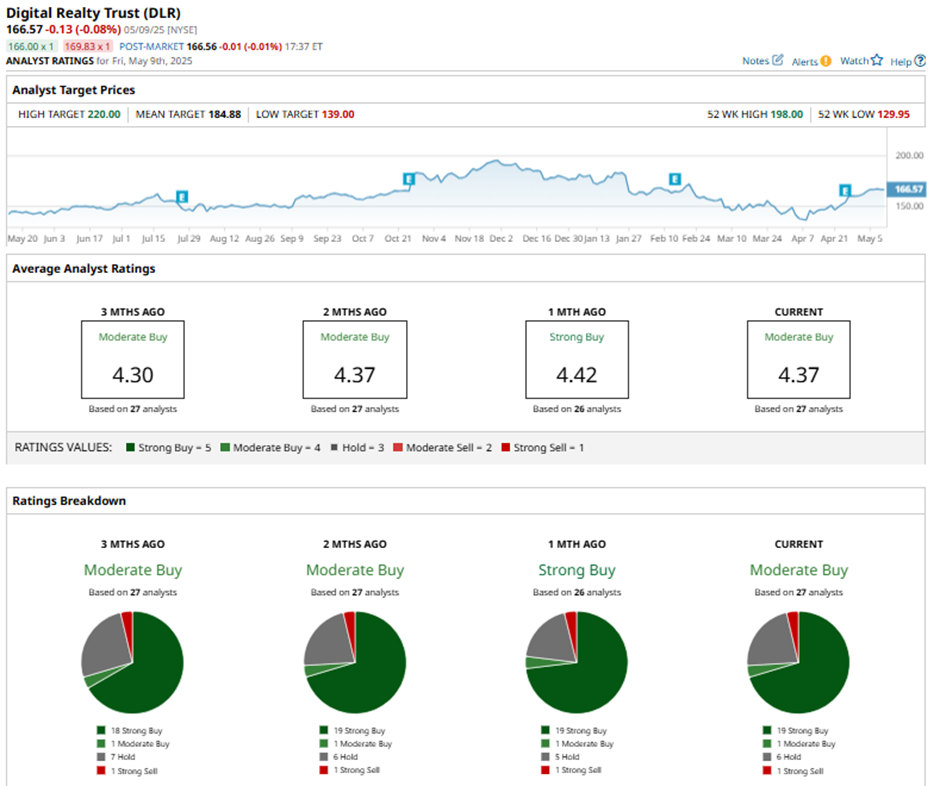

Among the 27 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 19 “Strong Buy” ratings, one “Moderate Buy,” six “Holds,” and one “Strong Sell.”

This configuration is slightly more bullish than three months ago, with 18 “Strong Buy” ratings on the stock.

On Apr. 25, Jefferies raised DLR’s price target to $193 while maintaining a “Buy” rating.

As of writing, Digital Realty is trading below the mean price target of $184.88. The Street-high price target of $220 implies a potential upside of 32.1% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.